Investment Strategies

Principles of Our Investment Objective

We primarily invest in Japanese logistics real estate assets. We pursue maximization of our unit holder value by securing stable earnings from our investment portfolio, growing the size of our asset under management and increasing the value of our portfolio assets.

Taking advantage of the strong sponsor support from the Prologis Group, we aim to steadily grow the size of our asset under management and enhance its value. We will strive to maximize our unit holder value through sophisticated stable operational management of logistics facilities, which will lead to the establishment of firm relationships with our customers as well as various logistics players. We wish that such our business activities will ultimately contribute to the benefits of various stakeholders such as Japanese consumers and our local communities.

Our Investment Criteria

As our investment target, we primarily focus on Class-A logistics properties in Japan, which are significantly important in our society as instrumental infrastructure. Through owning and operating such high quality logistics facilities in the medium to long-term, we strive to maximize our unit holder value by securing stable profitability of our asset under management, while we wish to contribute to future development of Japanese logistics industry.

In our investment, we prioritize the locations and specifications of targeted logistics facilities. In terms of locations, we carefully analyze and select geographical areas that have significant and strategic competitive advantages as distribution hubs in the future. We diversify investment locations to mitigate potential concentration risks.

Portfolio Strategy

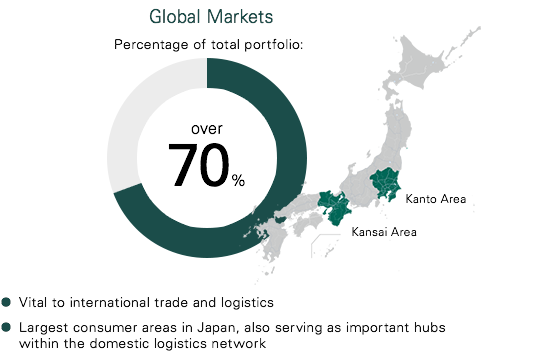

Geography

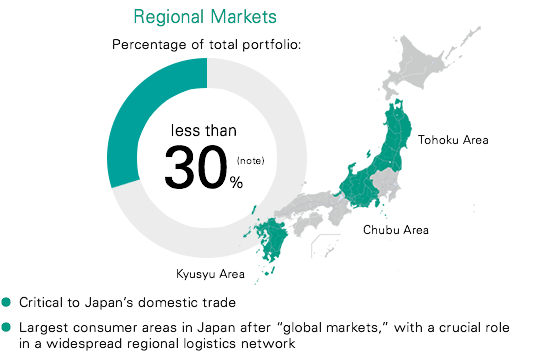

We will seek to build a geographically diverse portfolio targeting areas of Japan vital to international trade and logistics, which we call “global markets”. We also plan to target locations vital to domestic trade and logistics within Japan, which we call “regional markets.”

We believe that a geographically diverse portfolio will minimize fluctuations in cash flow due to regional economic shifts or localized impact from natural disasters.

- The percentage represented by Regional Markets (“Less than 30%”) includes investments in other regions that are suitable for logistics facilities, i.e., regions in close proximity to areas of high consumption or manufacturing

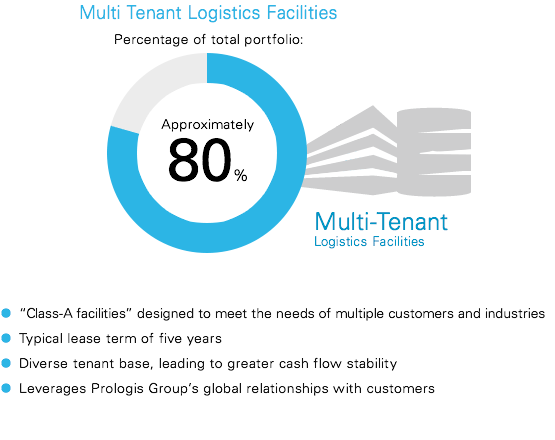

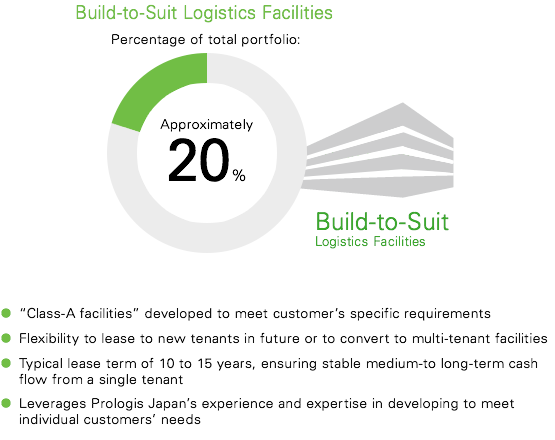

Property Type

We intend to strengthen the earnings stability of our portfolio by investing in a mix of “multi tenant” and “build-to-suit” logistics facilities. The breakdown of our portfolio by property type is as below (by investment value).