Financial Strategy

Financial Structure Positioned for Long-Term Stability and Efficiency

NPR strives to maintain a stable and flexible financing strategy that enables us to produce stable profits and achieve steady growth.

- When issuing additional units, we consider capital market trends, the economic environment and the timing of acquisitions, as well as dilution to existing unit holders, to achieve stable growth in the long term.

- We will maintain a conservative loan-to-value ratio (LTV) of approximately 50 percent, with an upper limit of 60 percent, except under special circumstances.

- LTV ratio is the ratio of aggregate principal amount of interest-bearing debt, including borrowed amounts, outstanding balances of long-term and short-term investment corporation bonds to the total assets of our portfolio.

Surplus Cash Distributions

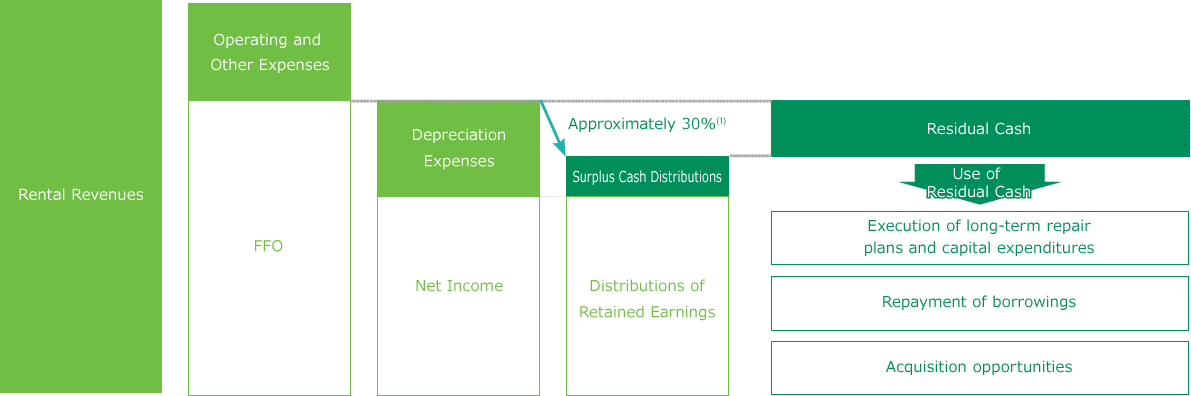

Logistics facilities typically have a greater amount of value allocated to buildings relative to other types of real estate; therefore, they have a higher depreciation expense. This is especially true of Class-A logistics facilities, which tend to have high value-added functional features. As a result, we expect that the depreciation expense for our properties will generally be higher than that for other asset classes or more conventional logistics facilities. Thus, in principle, in addition to distributions of retained earnings, we intend to make cash distributions on an ongoing basis to distribute a portion of the surplus cash accumulated, after considering alternative uses such as the execution of long-term repair plans and capital expenditures, the repayment of loans and acquisition opportunities. For now, we expect to target a level of surplus cash distributions on an ongoing basis at an amount equivalent to approximately 30 percent of the depreciation expense for the relevant fiscal period.

In addition, we may make one-time surplus cash distributions to maintain the stability of our distributions per unit in certain circumstances, while limiting for the time being the total amount of surplus cash distributions that can be made up to 40 percent of the depreciation expense for the relevant fiscal period.

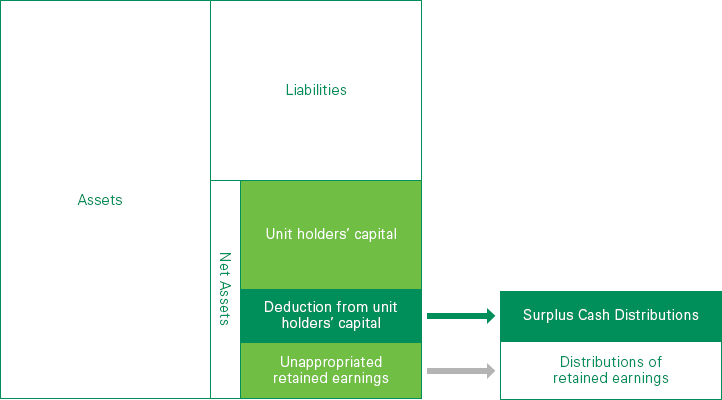

About Surplus Cash Distributions (return of capital)

Graphical Image of Surplus Cash Distributions on Profit/Loss Statement

- For the time being, we expect to target a level of surplus cash distributions on an ongoing basis at an amount equivalent to approximately 30% of the depreciation expense for the relevant fiscal period. In addition, we may make one-time surplus cash distributions to maintain the stability of our distributions per unit in certain circumstances, while limiting for the time being the total amount of surplus cash distributions that can be made up to 40% of the depreciation expense for the relevant fiscal period.